NFTs unbundle ownership from enjoyment

If you view NFTs as a progression of the unbundling of ownership and enjoyment, the enjoyment got digitized first. And now, we're seeing ownership being digitized. But digital ownership is kinda weird because it had digital properties like low cost to store and distribute, yet it's scarce.

After the last piece about DeFi, I wasn't going to write about cryptocurrencies for a while. But with recent chatter about Non-Fungible Tokens (NFTs), there's a surprising amount of fear, uncertainty, and doubt. I think people are mistaken when they write it off completely.

Hence, I wanted to put down my thoughts on why I think they're interesting. I'll quickly outline what NFTs are, what happened lately, and why they're valued, before we get to their future limitations and possibilities.

What are NFTs? The "non-fungible" in NFT means the tokens are unique and not interchangeable. In contrast, currencies like the US dollar are fungible–any dollar is equivalent to another. What use is a token that's unique from every other token? Real-world equivalents to NFTs we're familiar with are Pokemon cards and concert tickets. Every one is in the same category of things, but each one is unique.

NFTs are cryptocurrency tokens that represent the ownership in a digital asset. Like all digital assets, NFTs can be sent across the world immediately and requires little to no physical storage. But unlike other digital assets, they are unique, cannot be duplicated, and can only be transferred by their owners. That's why they're used to represent ownership of digital assets.

NFTs exist as data in a smart contract program written on a blockchain such as Ethereum. Think of the NFT smart contract data as a simple two column spreadsheet. One column is a unique 256 bit number as the id for the NFT, and the second column is a wallet address for the owner of that NFT. Optionally, there's a third column with a URL that points to where the image is hosted. An NFT is simply a row in this spreadsheet with these two to three columns. [1]

There can be many different smart contracts that contain NFTs, therefore, the uniqueness guarantee is only between NFTs in the same smart contract. Anyone can read the NFT, but only owners of an NFT can transfer it to another party's wallet.

Why all the hubbub (as of Mar 2021)?

As with anything, it's because someone paid $69 million for an NFT, and everyone else is scratching their heads wondering if these people have gone insane, or if it's something they should pay attention to.

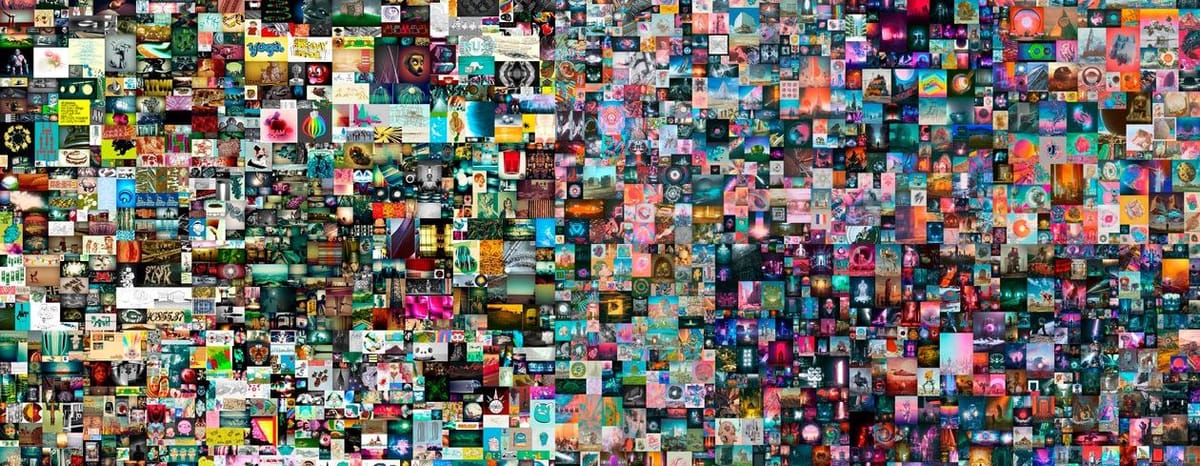

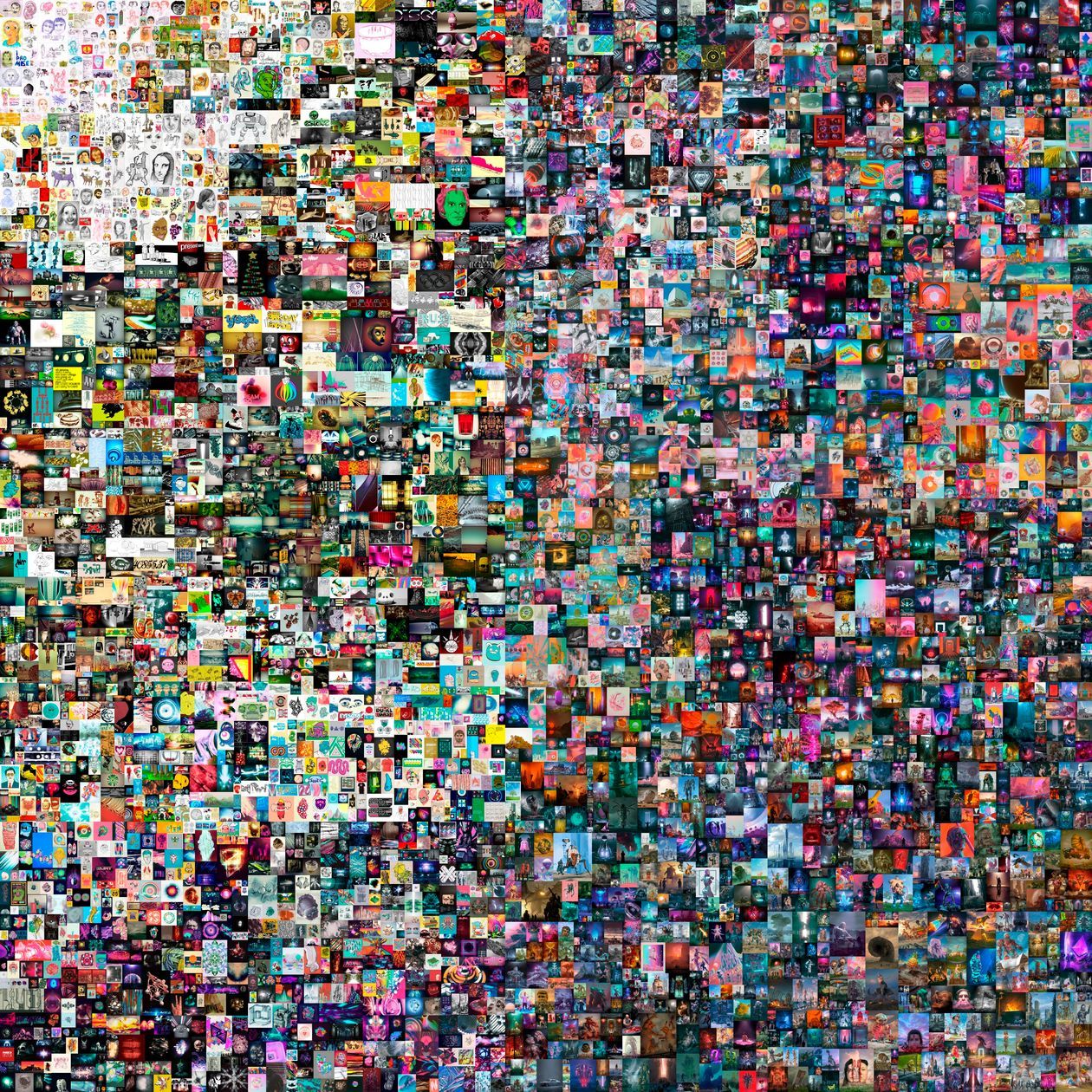

Beeple is a digital artist that has been creating digital art everyday for the last thirteen years and posting it on Instagram. His pictures are some mix of fanciful ideas and apocalyptic horror in an alternate universe that's a social and political commentary on current affairs. You can view the entire collection online here. [2]

Recently, he sold a NFT-backed digital collection, "Everydays: The First 5000 Days" through Christie's for $69 million. (or 42,329 ETH). Yes, Christie's just sold a JPG backed up a 3 column row in an immutable spreadsheet in the third largest sale for a living artist ever.

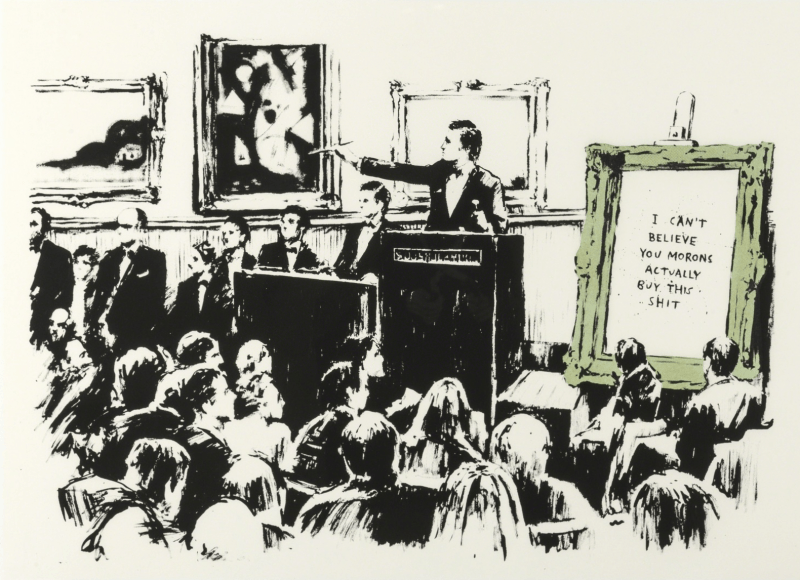

The sale of NFTs by content creators had been gathering steam in the art and music world for a couple months, if not longer, before Beeple's sale. Between the end of last year and now, the artist Grimes sold her digital art for $6 million, the band Kings of Leon released their album as an NFT, and an original Banksy, "Morons" was burned and "turned" into an NFT, and subsequently sold for $380k in Eth.

Jack Dorsey's (CEO of Twitter) first tweet sold for $2.9 million backed by an NFT. Basketball fans might have heard that NBA Top shot is selling NBA highlights as NFT-backed collectibles. Here's Lebron James blocking a layup from behind that's up for auction at ~$100k.

John Cleese mints an NFT with his crappy drawing of the Brooklyn Bridge to make fun of the NFT hype. It's a reference to George C. Parker, a con man that sold property he did not own–most famously the Brooklyn Bridge. Joke's on Cleese, the current bid is $35k.

If you've been following along, you might be scratching your head. You have a copy of Everydays: the first 5000 days right in your email / browser in this post. Check your mailbox outside for your $69 million check. Nothing. If you have a copy of the digital art on your own computer, don't you own the image?

Even if the art was purchased via an NFT, anyone can still view and copy the image. And the NFT doesn't even contain the digital art–it just contains a pointer to where the digital art is hosted. [3] If the database hosting the image goes down, then the NFT is linked to nothing.

What are you actually buying when you purchase an NFT? This is the part where lots of people seem to have a mental block, and are quick to write off and dismiss NFTs as a scam or just a fad.

I'd argue that the pleasure of ownership is separate from the pleasure of enjoying a digital asset. NFTs represent just the ownership in a digital asset, and that ownership confers its own distinct pleasures. When you purchase an NFT, you're buying the pleasure of ownership.

The slow unbundling of the pleasure of ownership from the pleasure of enjoyment

In the distant past, the only way to enjoy a piece of art was to own it. Wealthy patrons would commission artists to create art they could enjoy for themselves in their own private collections. Later, we invented art museums for public viewings, so you could enjoy art without owning it. But, you still had to be in the physical presence of an art piece to enjoy it. It's just how the physical world worked.

We lived with this limitation until the invention of recording devices like photography and VCRs. Then we digitized our recording devices, so computers can distribute them across networks to other people easily.

With digitization, you can enjoy the Mona Lisa on your screensaver anywhere in the world, and you don't need to be physically near it or own it. In the modern world, the pleasure of owning a piece of art is mostly separated from the pleasure of enjoying a piece of art.

But what does that mean for the value of ownership, if art can be digitized? How would ownership be enforced? We argued furiously in the courts for the last century about this question any time a new recording or digitization technology emerged.

In the end, the social contract we've collectively agreed upon is that the original physical art piece is worth a lot, and a copy isn't. [4] This mostly worked because you couldn't duplicate the original physical painting very easily. Because of this difficulty, we could use the the original physical painting's scarcity to signify ownership.

What about in mediums using analog recording devices like photography and print? There is no one single original physical piece. How would we signify ownership? In this medium, the creator can make a limited number of prints and then destroy the negative or stencil to enforce scarcity. Because of the difficulty of duplication without the negative or stencil, we can still use the physical prints to signify ownership. And to deal with expert art forgers, we'll back it up with a certificate of authenticity and an entire industry of forgery experts, authenticators, and fraud detectives.

The ownership, but not the enjoyment of a piece of art was still scarce and backed by the reality of physics.

What about digitally native art drawn in Photoshop? It never had a physical component to begin with, so how would we signify ownership for something with zero-cost duplication and distribution? For the longest time, we didn't know how to make digital things scarce and original. In fact, that's why we thought the internet revolution was so great. No cost duplication with no cost distribution has changed the world.

But as it turns out, you can make digital things scarce, through cryptography.

So if you view NFTs as a progression of the unbundling of ownership and enjoyment, the enjoyment got digitized first. And now, we're seeing ownership being digitized. But digital ownership is kinda weird because it had digital properties like low cost to store and distribute, yet it's scarce.

Hence it's easiest to think of NFTs as the certificate of authenticity for a digital asset that confers the pleasure of owning something, not the pleasure of enjoying something. Even if the digital art is easily copy-able, the certificate is not. When you buy an NFT, you're buying the certificate that represents the ownership of a digital asset.

What does ownership confer?

What is the pleasure of owning something? How is it different than the pleasure of enjoying something? Is not the enjoyment of the piece all that one can take pleasure in? I'd argue the pleasure of ownership is distinctly different. It can be uniquely cordoned off from the pleasure of enjoying the piece.

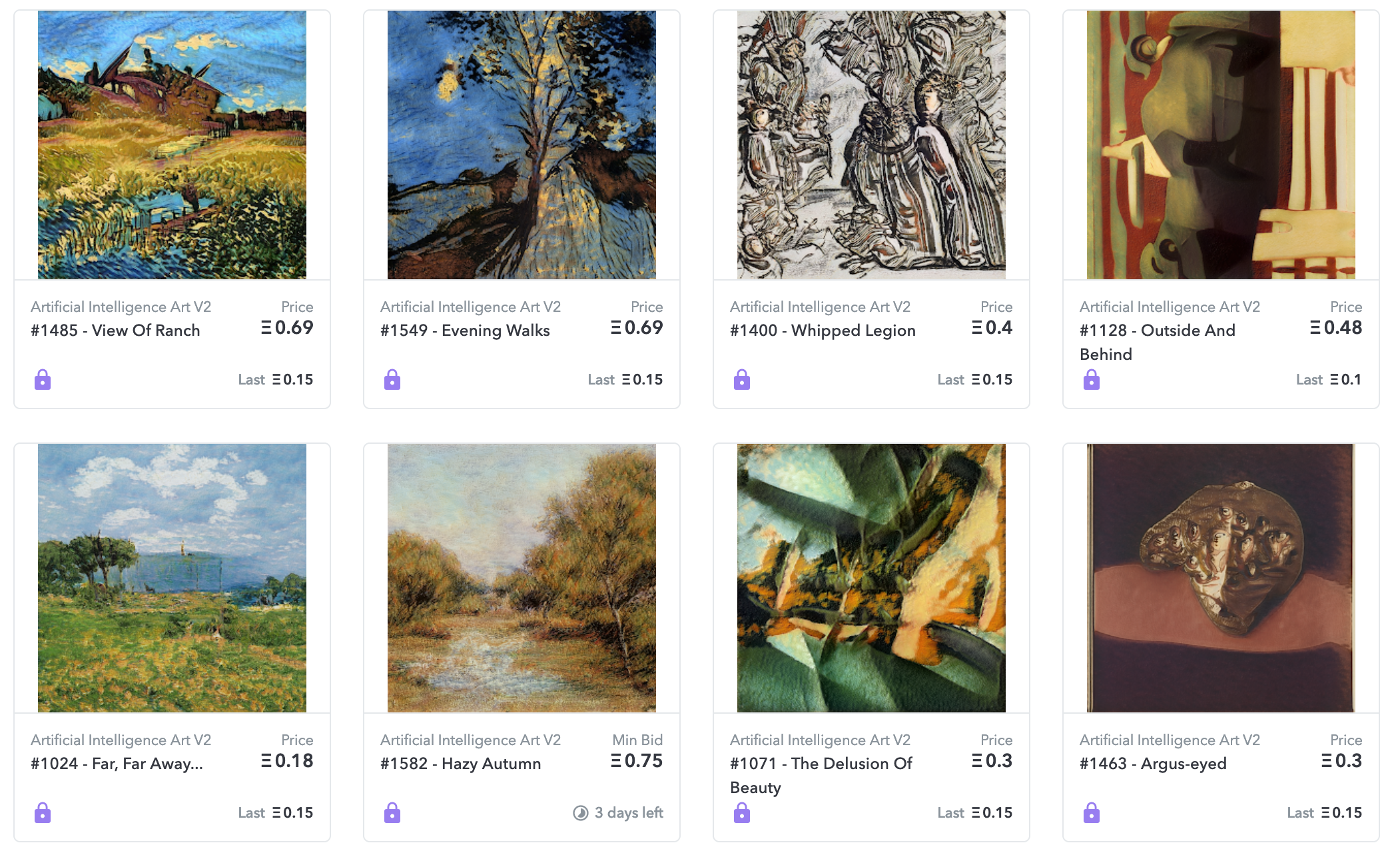

For one, you can now sell the ownership to someone else on the open marketplace, like OpenSea.io. Because there was no physical aspect to digital art to leverage as a signifier of ownership, it was impossible to sell digital art before NFTs. [5]

Despite the attention and his growing reach, Winkelmann [Beeple] never considered selling any of his work. Or rather, he didn’t really know how to sell it.

This is a common problem. As John Crain, the cofounder of the NFT marketplace SuperRare, explained: “A lot of supertalented digital artists don’t fit the model for the contemporary art world. They don’t go to Art Basel. They’re active on GIF communities. They weren’t monetizing the work as fine art. They might have sold T-shirts on a Linktree.”

source

But beyond the speculative and resell value, the other pleasures of ownership are status, emotional, and communal.

Art as a status symbol is a commonly touted benefit of ownership. When everyone knows how much you paid for a completely extraneous piece of art, it implies you have so much disposable income, that you blew it on something completely unique with no utilitarian value. It's the theory of the peacock feathers. If a male peacock can sport costly-to-grow, aerodynamically cumbersome feathers, and display scintillating features–but still escape predation, then they must be genetically fit in spades. It's the same principle at work in many of the items we buy to signify our group membership and strata in society. But there's more to NFTs than just a flex.

When it comes to the emotional value, there are just some pieces of culture in books, movies, music, and games that makes a deep connection with us. Sometimes the resonance is so deep, we become super fans where we wish to be a part of that world. But since it's impossible to inhabit a fictional universe, the next best thing is to make a small part of it real in our own. You can see this phenomenon at Comic Con, super fans attend panels and buy up merchandise from their favorite shows and games.

In the crypto world, there are people that derive emotional value from their NFTs as well.

Cryptopunks is an art project consisting of 10,000 pixelated cartoon profiles. It's the original inspiration for the ERC-721 standard for NFTs. That is a unique story that bootstraps its initial appeal, but it has grown from that starting point.

Dylan Fields, the founder of Figma, is a fan of Cryptopunks. He talks about his emotional connection to CryptoPunk 7804 on Clubhouse.

Of the 10,000 CryptoPunks, there are only 88 zombie punks, 24 apes, 9 aliens, and exactly one alien punk smoking a pipe. It's name is 7804, and I personally believe that in 100 years, we look back on 7804 as the Mona Lisa of digital art...

It wasn't just how rare it was, though it was rare. 7804 compelled me. It had gravitas. I found it to be absolutely magnetic. And I had a sense that others out there would feel the same way.

This might sound absurd to those listening, but many of us in the community have formed deep relationships with our punks. We set them as our avatars, we discuss them ad nauseum, we even dream about them. The punks become deeply intertwined with our identities. They effectively function as masks.

source

Dylan recently sold Cryptopunk 7804 to @peruggia for 4200 ETH, or $7.57 million at the time of this writing. It sounded like a bittersweet parting.

So, why'd I sell 7804? To be completely honest, is because I want to see 7804 become the patron saint of digital art. It bothered me that it was not universally acknowledged that 7804 was the best, most valuable, CryptoPunk. It bothered me that it was not a symbol for the entire crypto art movement. And there's a paradox, because 7804 cannot be seen as a symbol for the crypto art movement unless it changes hands.

7804 was purchased by a mysterious figure known only as @peruggia...Since purchasing 7804, @peruggia has made a beautiful statement on twitter which I encourage all of you to read. And as I reflect on it, 7804 has been surprising emotional for me, which I think speaks to its power.

It's emotional not because I think I could get more money from it, rather because I had a relationship with the work. As I reflected on the sale, I felt a very deep bond to @peruggia, the new owner of 7804. I don't know who @peruggia is, what their gender is, what ethnicity they are, or where they live. But I have found someone that appreciates 7804 as much as I do.

@peruggia, if you're out there listening, enjoy your time with 7804 but please know that owning 7804 is a paradox and possibly a curse, because if you appreciate 7804 as much as I do then you'll stop at nothing to make sure it is seen by everyone as the most valuable piece of digital art. And because of that your time will be limited with it. And when you sell it, which you will, you will forever live with the question of why you parted ways with a digital Mona Lisa.

source

How could one be so emotionally attached to 24x24 pixel art? The same way we derive meaning and value for anything above the utilitarian value. Dylan created his own mythos and meaning behind 7804. He called it the Mona Lisa of digital art. It's an avatar it's come to be a stand-in for both himself and the crypto art movement he stands for. As for his wish for 7804 to change hands, but carry with it a purpose of spreading crypto art? It's become the Dread Pirate Roberts for an idea.

And if you buy the story and find it compelling, you'll start to see 7804 as having value. You might even want to own it.

It's the same with the flag of a country. Why would so many march to battle under a banner of colored fabric billowing in the wind? Because they buy the story of the nation it represents. With stories, come meaning. From meaning, comes value.

Other than an emotional value, the pleasure of ownership can confer communal value. If it was just Dylan playing with 24x24 pixels by himself, it'd be much easier to write off. But he also mentioned that in his perspective, the CryptoPunks art piece was not the image itself, nor the NFT, but the community surrounding CryptoPunks. The NFT is his member badge. Here's Dylan again:

I also believe the question of "what is art?" would propel the crypto movement forward. So what is art? What does it mean to own art? What does it mean to have a relationship with art?

You might say that the CryptoPunk art piece is the algorithm used to generate the CryptoPunk images. Or you might claim that the art piece is each individual punk. I personally believe the actual art piece is the CryptoPunks community which had been feverishly speculating on and trading punks and discussing punks for the last three and a half years. source

But what is this community like? There's no universe or backstory behind the CryptoPunk characters. What could the super fans possibly be talking about? On first glance, it seems absurd. But then I remember Hello Kitty is a worldwide brand with millions of fans, and as best as I can tell, most of them don't even know or care there's a flimsy story behind Hello Kitty.

It seems the community is attractive because they treat each other well to move something bigger than themselves forward. Here's @peruggia talking about the CryptoPunks community:

One member had a punk that was in my mind more than fairly priced. He dropped the price to what I view as below market to allow the first-time buyer to get his first punk at a price he can be proud of. The cryptopunk community really is a sight to behold!

Here, the pleasure of ownership is access to a community that treats beginners well, who holds similar values, and believe the same stories. The internet has been able to do this without NFTs, but I think ownership and purchasing is another powerful mechanism to help build community.

There are other pleasures of ownership, but these additional pleasures depend on those that confer power and privileges to NFT holders.

Who confers the power of ownership?

Even if you have unique ownership of an NFT, who confers power on the NFT? It largely depends on the counter-party you're interacting with over the NFT.

Creators would be an obvious first counter-party to the fans. Creators want to build a community of fans, hence they're incentivized to confer additional pleasures of ownership to their NFT holders–their super fans. They may hold a meetup for their super fans to meet them. They may airdrop behind-the-scenes sketches to the final piece to the NFT holder wallets. Or they may give token holders early access to view or bid on their yet-to-be-released art pieces.

You'd only need to look at the rewards for stretch goals of Kickstarter campaigns to see creators already do something similar. Jason Fried of Basecamp talks about selling your by-products, and creators are finding the by-products of their work to be valuable to super fans. NFTs are a missing tool in a creator tool belt to help build and solidify a loyal following of fans, by giving them collectibles they can own.

In fact, there's many ways for creators to establish a relationship with fans and token holders through NFTs. To start, creators no longer need to chase down every use of their creative work for royalties. Instead, they can structure the NFT to charge royalties every time the work is purchased and transferred between wallets.

This is possible because NFTs are programmable certificates, like how cryptocurrencies are programmable money. The design space for what happens when NFTs are minted, transferred, sold, or destroyed is wide open.

For example, Neolastics is an experiment in creating an autonomous artist. The Neolastics NFT implements a bonding curve, so as more NFTs are minted, the price goes up. And if price gets high enough, owners can burn their NFT to get its value back, but the burned NFT will never be minted again. This rewards early adopters and sets a market-force induced price, as well as leveraging human tastes for the autonomous artist's art.

Creators can explore whether it's possible to create an NFT that degrades the art with every repurchase. Or create NFTs that exerts control over digital art that changes piecemeal as the owners change hands. Or create NFT that slowly reveals itself as the piece is bought, sold, and transferred.

Some creators have already started using cryptocurrencies and NFTs as club member badges, broadly categorized under the name, social tokens.

One prominent example of a social token is $RAC, a community token by the Grammy award winning recording artist RAC, issued through Zora. Token holders get access to a private Discord group and receive early access to merch drops with more perks to be added in the future. The token was retroactively distributed to his supporters including Bandcamp and Patreon supporters, people who had bought merch, and will eventually be distributed to all Twitch supporters.

- A beginner's guide to NFTs

However, there is a limitation. The pleasure of ownership is additive, not subtractive: you can only get additional benefits as an owner, but cannot take away someone else's access or enjoyment of the work.

There are other parties that can confer power onto NFTs. As 3rd party developers have free access to NFTs on a public blockchain, they will create more things for people to do with their NFTs as many have done with web APIs. The difference here: as a public ledger, no centralized company can shut down access. It is this flexibility and promise of openness that will confer the power to the pleasure of ownership.

The tenuous connection between the certificate and the asset

NFTs are simply on-chain digital pointers to an off-chain digital asset. They can be URIs that point to a digital asset, or they can also be pointers to JSON metadata, which then point to the digital asset.

Why all this indirection? Ethereum was designed to be better suited for running business logic on a very small amount of data, than it is for file storage. [6] That's why NFTs usually contain URI pointers to digital art hosted elsewhere on the internet.

This tenuous connection is a misgiving many have about NFTs. What if the website hosting the digital asset at the URL in the NFT goes down? Wouldn't the NFT just point to nothing?

In fact, some people have started noticing their digital assets disappearing, and they're left with NFTs that point to broken links. Some are discovering the hard way that not all NFTs are created equal, and should take the proper precautions to be future proof. When an NFT points to a centralized database for its metadata and digital asset, it's at risk for pointing at nothing. Check My NFT is an early service that gives ratings on how future proof an NFT is.

There are currently multiple competing solutions for this problem, and more to come.

One solution is for the NFT to point to the digital asset hosted on Interplanetary File System (IPFS). IPFS is a decentralized network designed to host large files. Anyone can contribute their computer as a node to the network to help host files. This lowers the risk that a file is inaccessible when a server goes down. By using IPFS to host digital assets, there's less of a reliance on a single point of failure.

URIs on IPFS are content-addressable, which means the same file will always have the same address, even as nodes come in and out of the network. This provides a stable URI for NFTs to point to, and helps ensure permanence. [7]

Here's the "5000 days" at full resolution file hosted on IPFS accessed through the ipfs.io gateway (it's ~300 MB). As long as one or more nodes pin this file, it will exist on the network. However, if no node pins the content, it will expire after some amount of time when the network runs garbage collection.

While there are pinning services, such as Infura, Eterum, and Pinata, they are centralized companies with a non-zero risk of going out of business. Hence, there are people are working on fully decentralized solutions for a permanent web.

The team that built IPFS is also working on Filecoin, a cryptocurrency token for decentralized storage. It interoperates with IPFS as an economic incentive for people to run hosting nodes on top of IPFS for a pinning solution that doesn't rely on a single centralized service.

There are other projects and companies working on decentralized storage like ARWeave, SiaCoin, StorJ, and Ethereum's platform native Swarm to help solve the permanence problem. To my knowledge, IPFS, ARWeave, and Swarm are currently most used for NFTs.

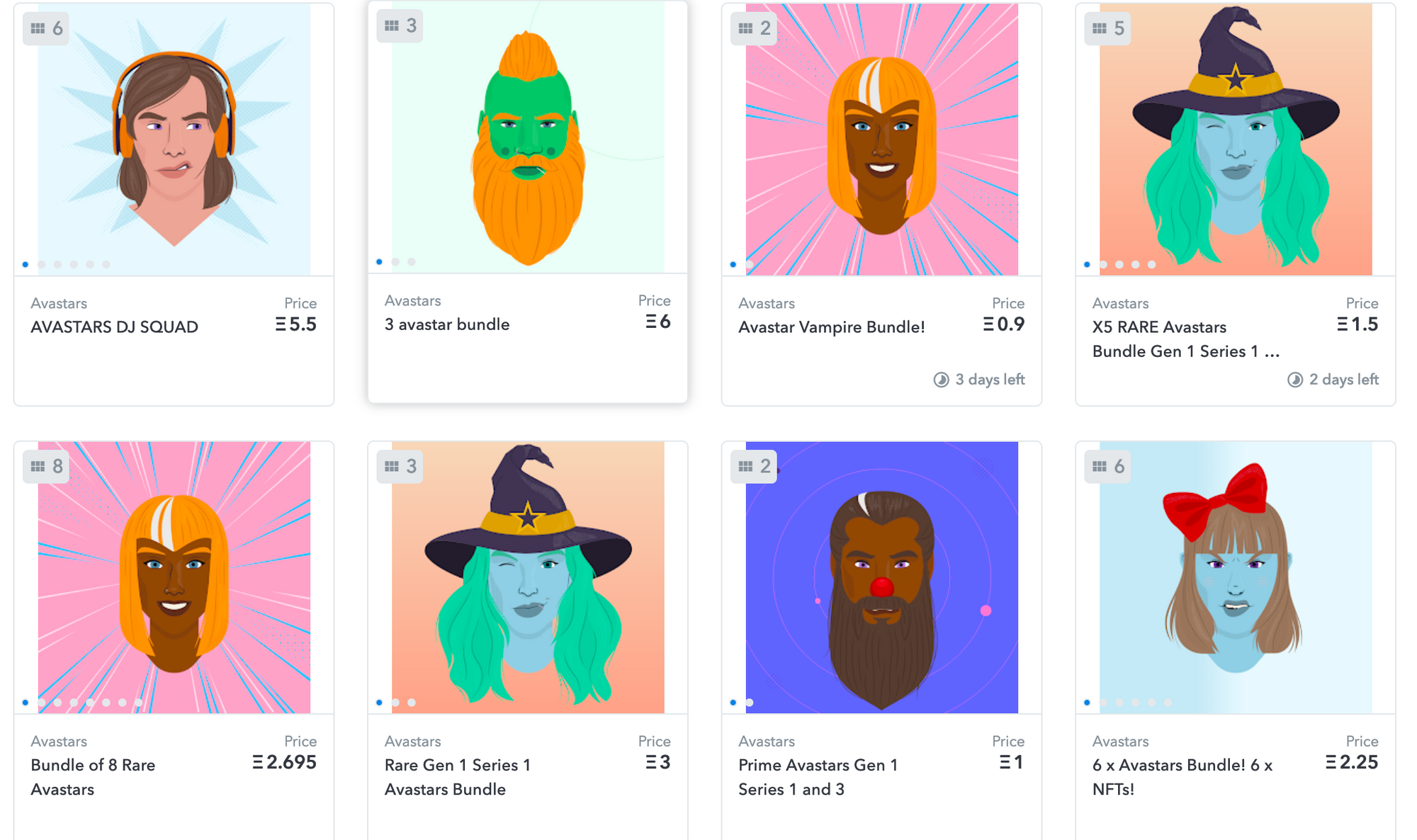

Another solution is to procedurally generate digital art given some input parameters and just store the input parameters on-chain. Avastars is an NFT that takes this approach by treating input parameters as traits, such as hair, eyes, and mouth. Then the portrait composes the traits into a final portrait.

The project also takes it one step further by storing SVG images of each trait on-chain. They wrote 2.5 MB on-chain in Feb 2020, which is infeasible today given the average gas price. As of this writing (Mar 2021), it would cost somewhere in the range of $130,000 dollars to write 1 MB on-chain. [8]

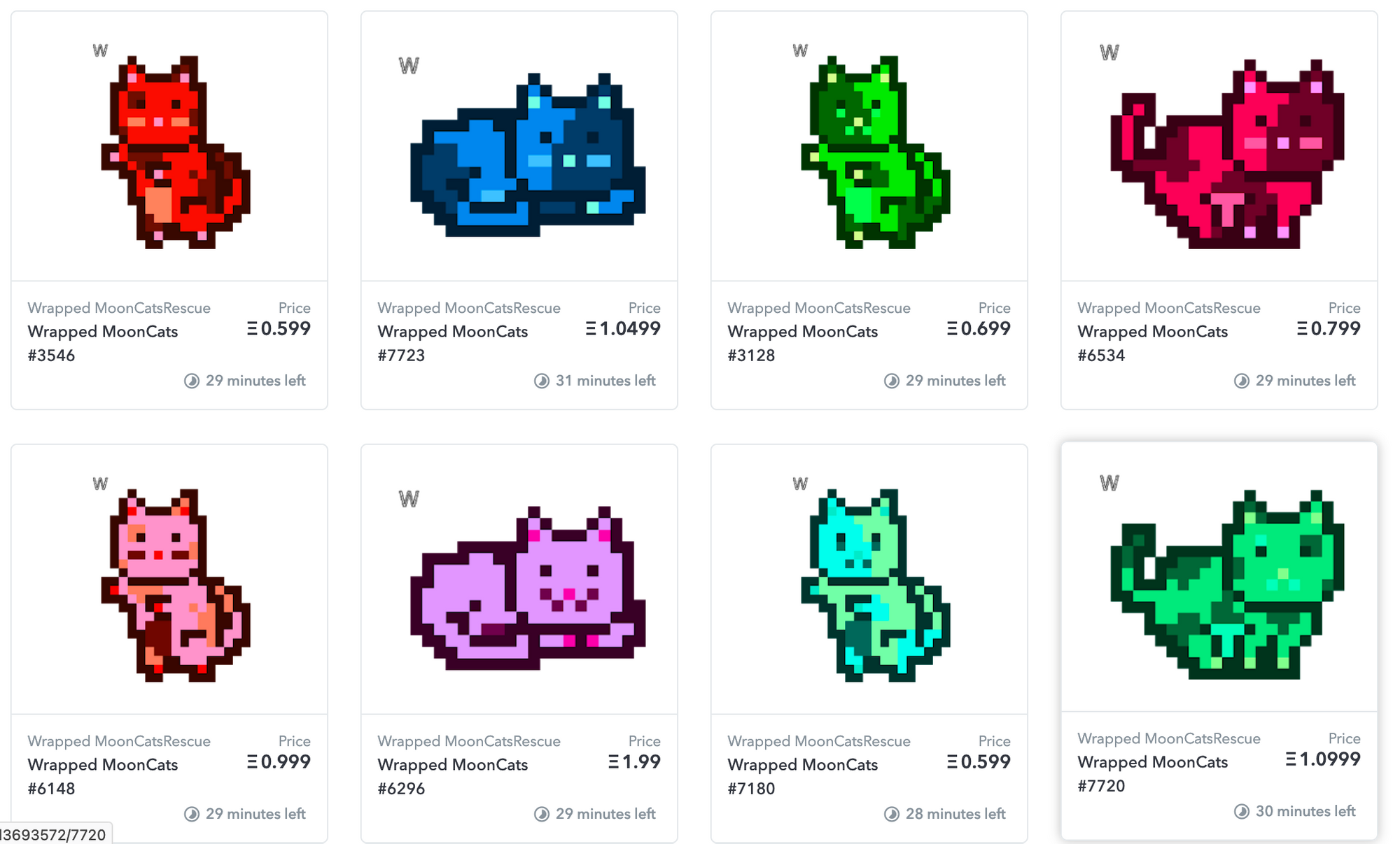

Instead of pulling images from an on-chain storage, another solution is to generate the image with an off-chain algorithm, but store the verification of the algorithm on-chain. One of the oldest NFTs, MoonCatRescue takes this approach. It offers the pixel image generation algorithm on github, and records the md5 hash of the algorithm on-chain, so you can be sure the image generation algorithm you're using is the one that's intended.

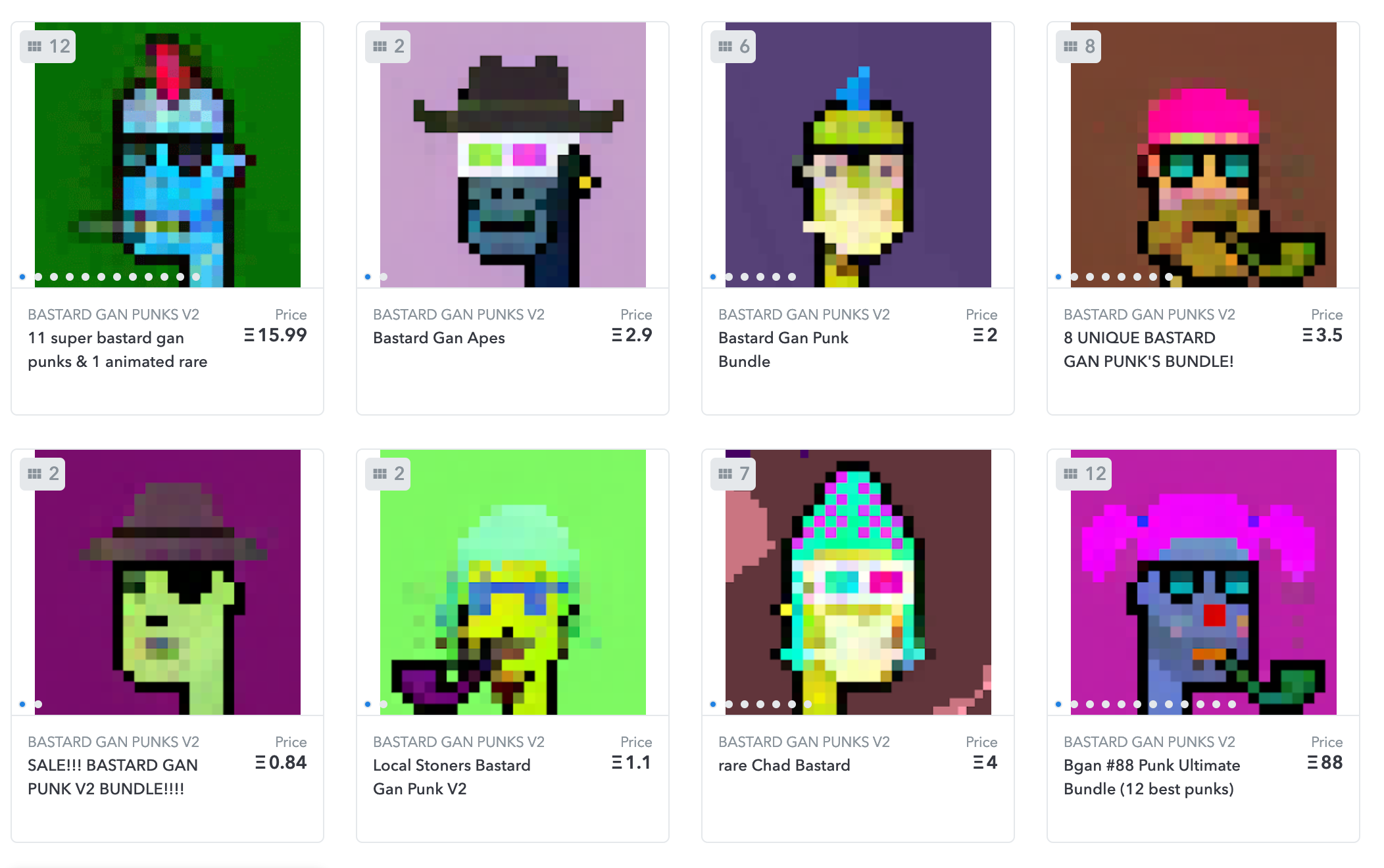

Beyond relatively simple image composition and pixel pushing to generate images, it's possible to use neural networks called Generative Adversarial Networks (GANs) as generation algorithms for NFT art.

If you're unfamiliar with GANs, you've probably seen images generated by one. This Person Does Not Exist, is a site where a GAN generates photo-realistic pictures of people that have never existed. Using the same neural network, people have generated all sorts of things that never existed, from cats to anime.

As a riff off the original CryptoPunks, there's Bastard GAN Punks that uses GANs to generate even more Punks by training on the original 10k Punks.

Other GAN art is generated by training it on existing art pieces, and see what it comes up with.

A GAN is essentially a function that takes an input vector and maps it to an output image. Even more interesting and unique to digital art, you can stuff the GAN with a series of input vectors, and you can see the output image transform. The series of input vectors is effectively traversing a path through the vector space. This path is very much like taking a tour through a very small slice of what the GAN can hallucinate. This is also being sold as art.

There are other artists in the burgeoning generative art market. However, none of them seem to store the input parameters on-chain and use parameters as input into a GAN with publicly known weights to generate the image. That should be a viable solution to this problem of storing digital assets permanently.

Even with the tenuous connection between NFTs and the digital asset, the demand from creators and collectors is there. I surmise the problems of permanence and the link between NFTs and the digital asset they represent will get solved.

Some common objections

Can't someone deploy an identical smart contract for my NFT on the same chain? What's to stop someone from tokenizing digital assets they don't own, like other people's art? [9] They could, but it likely wouldn't be recognize as legitimate.

Legitimacy is a pattern of higher-order acceptance. An outcome in some social context is legitimate if the people in that social context broadly accept and play their part in enacting that outcome, and each individual person does so because they expect everyone else to do the same.

- Vitalik Buterin

The creator of an NFT collection has power to christen an NFT smart contract as the official one. It's power conferred by social contract from collectors and creators when we all agree that this is the legitimate contract for CryptoPunks, and not that one.

Creators can also register human-readable names that point to Ethereum addresses with the Ethereum Name Service (ENS). For example, crytopunks.eth can be registered and owned by the creators of CryptoPunks. They can point the human-readable name to the official smart contract governing Cryptopunks. And the human-readable names themselves? You guessed it, they're NFTs.

It is also entirely possible there's a scenario where we collectively agree both NFT contracts are legitimate, but they represent different communities or use cases. Bitcoin has forked a couple of times into Bitcoin Cash, Bitcoin SV, and Bitcoin Gold, and these other forks still see smaller, but non-zero trading activity. Fans of an artist may become polarized, and decide to fork an NFT contract. I believe it will happen at some point.

What about the environmental impact of NFTs? This is a big topic that I can't cover fully here, but the cryptocurrency detractor's rhetoric usually belies the nuance on this topic. There's other people that cover this topic in depth. What I can tell you:

Ethereum energy usage depends on the number of miners, not on the number of transactions. So even if you don't mint or transaction NFTs, they will be filled up with other transactions. It's like telling people not to ride a bus because the bus guzzles gas. The bus will be filled with passengers, even if you're not on it. There's a whole wide world of applications besides NFTs on Ethereum.

Ethereum has been actively moving to Proof of Stake from Proof of Work. There's also work on layer 2 solutions where computation can happen off-chain, but can be proved it was done correctly on-chain. Both are significant technologies with a lot of effort behind them which lowers the energy consumption requirements significantly and improves the transaction throughput at the same time. [10]

NFTs beyond art

Now that you have a better sense of what NFTs are and their limitations. What is actually interesting about NFTs? So far, I spent all my time talking about NFTs as applied to art. But NFTs have other applications beyond the art market. There's too many for me to cover, so I'll just outline a couple I find interesting.

As more of our lives move online, creators want a way to charge directly for their work. When digital things couldn't be sold directly, we had to come up with workaround business models, such as advertising, subscriptions, Kickstarters, and Patreons.

Before, we had to sell access to the creation, which limits their distribution. Making money was at odds with distribution. But with NFTs, we can turn that on its head and push distribution widely and sell a collectible attached to it. Arguably, the collectible becomes more valuable as the work is distributed widely.

That could possibly be an interesting business model for authors. Instead of a subscription model like substack where you charge for access, the essay is freely available to read, but choice quotes can be purchased as NFTs.

Mirror.xyz is exploring alternate models for funding writing, such as crowdfunding essays with tokens and selling the essay as an NFT. John Palmer raised 9.98 ETH to write an essay called Scissor Labels. The backers are permanently etched at the end of the essay, and the essay itself is hosted permanently on ARWeave.

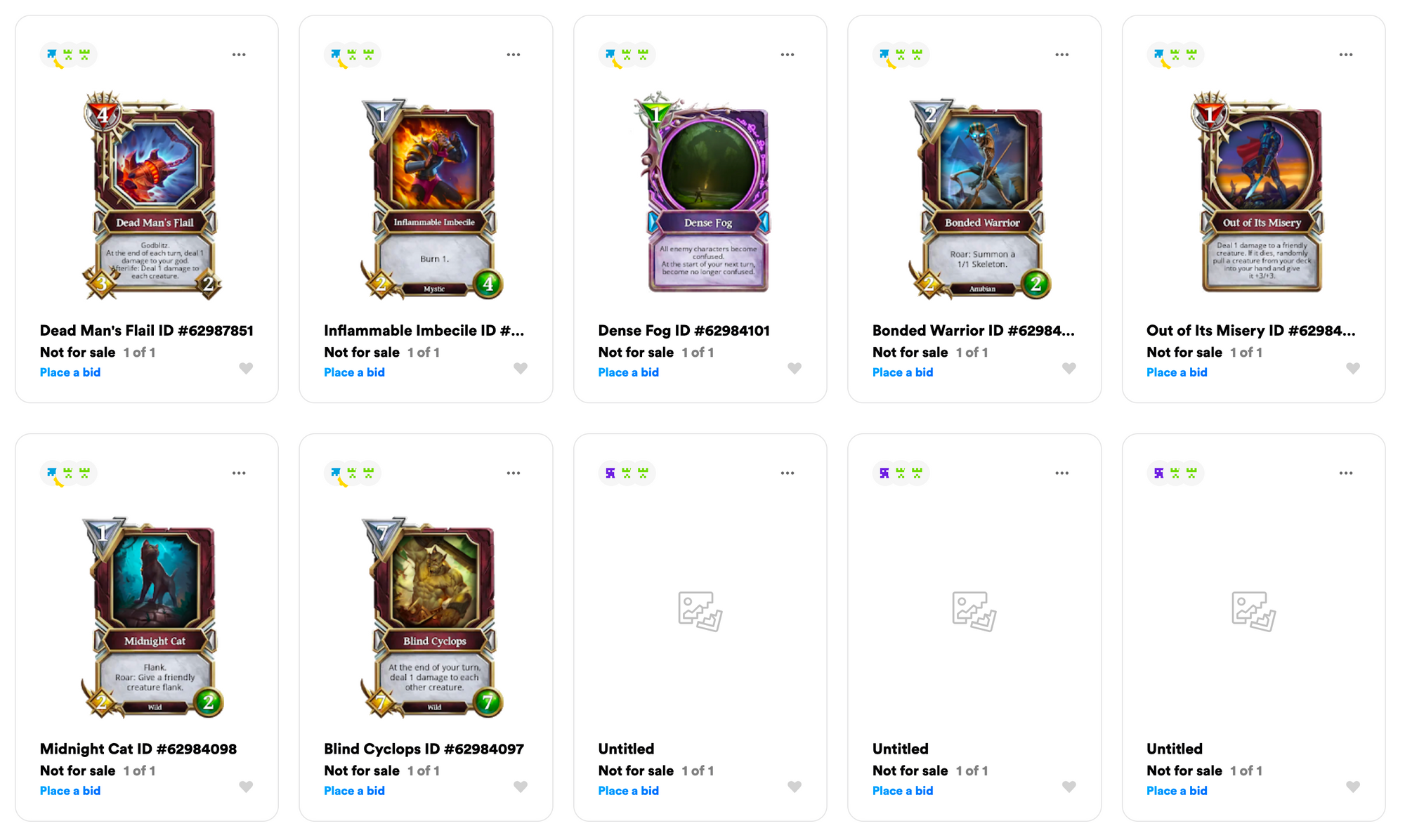

In a completely different space, NFTs is often used for in-game items, like Gods Unchained, Sorare, and Axie Infinity.

Interestingly, game designer James Portnow of Extra Credits laments current blockchain games don't actually take advantage of the design space a public ledger affords. Game items NFTs can be a public record of who owned it and what deeds they accomplished with it. Instead of grinding to level up gear, that collection of deeds would be the mechanism with which to level up an item.

Imagine and MMORPG where a sword gains power not by some mechanistic enchantment system, but rather by the heroic events it was involved in.

You start a game using a simple iron sword, you progress and level, and eventually use it to slay a boss named "Grillmig the Orc". Suddenly, your simple iron sword becomes "Grillmig's Bane", and with the name change, it gains some extra stats.

- "Blockchain Games" on Extra Credits

Interoperability between games is another interesting aspect NFTs enable. Because blockchains are public ledgers, NFTs can represent in-game items portable between games, if the game developers support it. Cryptokitties and Gods Unchained did an one-time event where you could use a Cryptokitty to forge a unique and tradable talisman in Gods Unchained. This interoperability allowed two smaller studios to do cross-promotional events more easily. They didn't have to have their engineers hop on a call with each other.

Interoperability also allows other developers that build tools and marketplaces and other infrastructure that would otherwise take more effort than any one studio could build alone. Interoperability can be used strategically by smaller game studios the same way that web APIs are used by startups: it can be a way to handle long tail use cases, a means of distribution, and a way to build a developer community.

As a subset of interoperability, NFTs can be composed, and NFTs can be fractionalized.

What does it mean that NFTs are composable? Because NFTs are a standard interface on a publicly readable blockchain, it can be combined with other Ethereum applications and data like Lego blocks. Decentralized Finance (DeFi) is an ecosystem of money markets, exchanges, and collateralized loans. NFTs can plug into this ecosystem, so it is conceivable to build a service that where you can take out a loan out with your game item or domain name as collateral.

Additionally, NFTs themselves can be composed. For example, a different developer than the original Cryptopunks is making bodies for the Cryptopunks.

Other developers can even build upon those game items to build new games. KittyRacers(now defunct) and KittyHats are games and collectibles that build upon Cryptokitty NFTs without needing to coordinate with Cryptokitties.

NFTs can be fractionalized. Fractionalization is where an NFT can be made fungible, so there can be multiple owners for the same NFT. It's conceivable to build a fund around fractionalized NFTs, where its members can decide collectively which NFTs to hold on to, and which ones to sell through a voting system. These collectives are commonly known as a Decentralized Autonomous Organization (DAO). Here's a beginner's guide to DAOs.

We’ve also seen DAOs emerge that are catered for more specific investment opportunities such as owning NFT art and virtual gaming items. Yield Guild Games is a play-to-earn gaming guild that is turning gamers into investors by buying NFTs in games like Axie Infinity, League of Kingdoms, and The Sandbox.

- Beginner's guide to DAOs

Rephrased, Yield Guild Games is a DAO comprised of players-turned-investors that speculative on virtual real estate (which are also NFTs). While there were MMO farmers before, NFT virtual land and items have a far higher liquidity because of the accessibility with multiple marketplaces and potential buyers from outside the gaming community. And parents in the 90's laughed that kids would never be able to make money playing video games.

NFTs don't have to represent just game tokens and art. An interesting use case is the Ethereum Name Service (ENS) mentioned earlier. It's a Domain Name Service (DNS) for Ethereum addresses.

Unlike DNS, the entire registry and auction mechanism is run on the Ethereum blockchain. Once deployed, it can't be shut down and is available as a public good. NFTs are a great fit for public registries that need to be read by everyone, but each registry entry is owned by a single entity. Unlike art and gaming NFTs, ENS contains all the data it needs on-chain, so it doesn't have the tenuous connection problems between the certificate and the asset, because the certificate is the asset.

There doesn't seem to be very many registry type NFTs. I'm not sure why. Perhaps because in the real world, registries are usually owned and maintained by governing bodies and standards bodies, and are not typically ideas entrepreneurs think about doing.

NFTs can also be used in Decentralized Finance (DeFi) on Ethereum. Uniswap, a decentralized exchange, just launched version 3. Liquidity providers can now take different positions in different ranges of prices, and the liquidity position is represented by an NFT. This position can now be traded on the open markets or bundled into other financial assets.

There's many more NFT spaces currently being experimented on, and the design space is wide open to touch many industries. It should also open up new ones we haven't seen before.

The hot take

With NFTs, the pleasure of ownership is unbundled from the pleasure of enjoyment. This lets creators build communities of super fans that are invested (literally) in their success.

Beyond use cases for creators, NFTs enable interoperability, and it's done with all the properties being built on the Ethereum blockchain affords: permissionless, decentralized, and with provenance. [11] This interoperability makes cross-cutting markets that just weren't feasible before. You can't put up your World of Warcraft character as collateral for a Chase Bank loan, because the systems that govern each are siloed from each other. With the NFT interoperability, it's possible to not just dream about it, but it's viable to actually build it, and test the market for it.

Fractionalization and DAOs sit at a different intersection of community building and coordination. It allows for organizations that aren't quite corporations, but not quite collectives to function towards a goal. They're another way for people to organize and work with each other that don't know each other, and don't have to trust each other.

In short, NFTs can help build community, interoperate between developers, and enable new types of organizations. Thematically, NFTs are a different kind of coordination tool to enable humans to collaborate in previously unseen ways and in greater numbers.

Humans have a limit to the number of people they can have personal relationships with, called the Dunbar's Number. This is probably due to the limit of the brain's capacity to fit more than around 150 relationships in our head. To surpass this limit, we invented cultural myths as tools to coordinate, trade, and collaborate in far larger numbers than the human brain could sustain. The corporation is one myth as a coordination tool. Money is another myth as a coordination tool. Both enable humans to cooperate without needing to know everyone else in the organization. NFTs is another myth as a coordination tool, and this is why I think NFTs have long term potential.

But with interoperability, the composability and fractionalization enables people to bundle digital assets together, and tear them apart. What happens when people bundle bundles of assets together? I'm reminded of credit default swaps that was at the epicenter of the 2008 financial crisis. Credit default swaps are bundles of mortgages that are considered to have value because it's built with an underlying assumption that most people pay off their mortgage. When that assumption was broken with more speculators in the housing market, very few people buying the bundled asset noticed. Would the same thing happen in the crypto ecosystem? Would permissionless composability make the crypto ecosystem more fragile?

Maybe, maybe not. At the very least, a public blockchain is inspectable by anyone, and unlike credit default swap data, so perhaps with many eyes, someone would sound the alarm. But I've not seen anyone ask the question. Maybe with cryptocurrencies so volatile already, no one thought to ask.

Lastly, what happens when everything digital can be owned? Property rights was the status quo in the world before the internet and the gatekeeping that went with it. The internet blew those gates wide open, and we've been giddy with opportunity since.

But now that the internet and its ethos has been infused in our daily lives, we find there are digital things we'd like to own. Would digital ownership stifle cultural creativity? Where does that leave public domain and fair use? The cultural media before the internet doesn't have a great track record of filtering out creative works to the public domain. The song Happy Birthday To You wasn't in the public domain until 2015. Culturally relevant speeches such as Martin Luther's I have a dream speech is still not in the public domain. Disney keeps extending and changing copyright law to keep their hold on Mickey Mouse. The previous generation keeps culture out of reach for the next generation to remix and meme.

As I said earlier, the early ethos of NFTs is composability, and ownership is additive, not subtractive. So maybe the mistakes of previous generations won't be repeated here. It remains to be seen how things will unfold.

At the end of the day, NFTs are public interfaces for digital assets with a unique ownership provenance for integration and interoperability. This has wide ranging implications for a variety of industries. To write it off simply because someone seems to have paid too much for a piece of art would be foolhardy. NFTs are pointing at the moon, and even smart people are shouting at the finger.

Other resources and reading

- A beginner's guide to NFTs by Linda Xie

- The non-fungible token bible by Devin Finzer

- A quick overview of the NFT ecosystem [2020] by Andrew Steinwold

- What does it mean to buy a GIF? by Jack Rusher

- A16Z podcast: All about NFTs with Jesse Walden, Linda Xie, and Sonal Chokshi

- Simon de la Rouviere's substack

- Nonfungibles and DappRadar

Thanks to Ricky Yean for reading the draft and encouraging me to finish.

[1] On Ethereum, the main interface standards for NFTs are ERC-721 and ERC-1155

[2] As an aside, I'd check out his collection. With art in a museum, you usually need the context of art history to fully appreciate the piece. With Beeple, if you've been paying any attention at all to current affairs, you'll have enough context to understand the commentary. If you notice, that additional context gives more meaning and value to the picture than what you see on the canvas. That additional context is also what gives value to 24x24 pixels.

[3] The ERC-721 standard allows the URL to not point directly to the image, but to a JSON metadata, which then points to the URL. I'll address this directly, if you keep reading.

[4] By social contract, I mean it in the same way we all agree that currency has value. It's a collective myth that we use to lubricate cooperation between strangers.

[5] While you could sell MMO characters on the open market, it's not quite considered art. It has a utility value inside of the game world.

[6] I can only speak to how the Ethereum blockchain works. It's currently the largest smart contract ecosystem, and many NFTs are hosted there--though some significant NFTs are not, such as NBA topshot (on the Flow blockchain).

[7] Some NFTs erroneously reference an IPFS gateway in the URI. This can be a risk if the company running the IPFS gateway goes away. The NFT should instead reference the IPFS URI in the form of ipfs://{content_address_id}, and leave it up to clients to pick their own IPFS gateway.

[8] 1 MB = 220 bytes

1 word in Ethereum is 256 bits = 28 bits = 25 bytes

cost to write 1 word = 20,000 gas

1 Gwei = 1x10-9 Eth

current average gas price = 124 Gwei

current Eth price = 1,619 USD

(220/25) * 20,000 * (124 * 1x10-9) * 1619 = $131,567.45

[9] There is a collection of Bible NFTs on OpenSea.io.

[10] I've focused on the Ethereum blockchain in this article, since it's where most of the NFTs live. There are other blockchains with NFTs, such as Flow and Hic et Nunc built on the Tezos blockchain.

[11] NFTs are permissionless: you don't need the blessings or coordination from the original creators of the NFTs to build on top of them. NFTs are decentralized: a community can keep using NFTs long after the original creators are gone. NFTs have provenance: it keeps a complete history of all its previous states in the past, especially who owned it for how much. The benefits of this should be obvious to anyone that has tried to build on Web 2.0. As a 3rd party developer, you're not at the mercy of the platform provider, and a complete history for the data means more possibilities and products to surface.